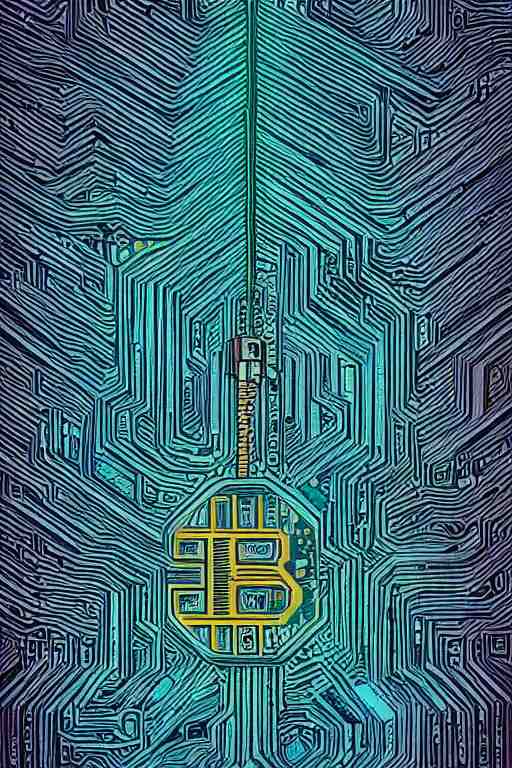

Arbitrage is a common practice in the world of cryptocurrency. In this article, we will explain what it is and how you can use it with a new tool that helps you find arbitrage opportunities.

What is arbitrage?

Arbitrage is a trading practice that seeks to make profits by finding mispricing in financial assets. It is known as an alpha by most hedge funds and it is a strategy that makes profit regardless of the market trend. This strategy was initially developed for the stock market, but has its own version for cryptocurrencies.

Now that we know what arbitrage is, let’s see how to make money with it. This tactic can be applied to most cryptocurrencies, but there are some that are better for arbitrage. In general, those coins with a high liquidity and volume are recommended. This means that the amount of buy and sell orders is high enough to make a profit. Some examples of good altcoins for arbitrage are Bitcoin, EOS, Tron, and Litecoin. But this does not mean that altcoins with lower liquidity are not profitable to trade, they just require more effort to find the right arbitrage opportunity.

The most common form of this activity is called “pair trading”; where an investor simultaneously purchases the same asset on two different exchanges at two different prices and sells them on another exchange to take advantage of the difference in price between them. But there are more advanced forms of arbitrage like “arbitrage bots” which use APIs to automate some of the process.

As you can imagine, this practice has gained popularity among cryptocurrency traders in recent years. This is due to the fact that cryptocurrency markets are very volatile and the difference in prices between exchanges can be significant at times. This generates excellent opportunities for traders who want to earn money fast and easily.

How do arbitrage bots work?

Arbitrage bots work by purchasing an asset on one exchange at a low price and simultaneously selling it on another exchange at a high price, thus pocketing the difference as pure profit. To implement this type of activity efficiently, you need an arbitrage bot that works with APIs to connect several exchanges at the same time.

Which currency should I use?

There are many different APIs available that allow you to perform arbitrage activities with different programming languages like Java, Python or Javascript. The most popular one by far is the Arbitrage Opportunities API which works in the

Supporting over 120 exchanges and 1400 pairs, you will find arbitrage opportunities with this API.

To make use of it, you must first:

1- Go to Crypto Arbitrage API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.